Consumer Legal Services

Our market

The Consumer Legal Services division serves the personal injury and residential conveyancing sectors of the legal services market. The division provides outsourced marketing services to law firms through the National Accident Helpline brand and claims processing to individuals through National Accident Law (NAL), and its joint venture LLPs, Law Together and Your Law. It also provides property searches through Searches UK.

The personal injury market has undergone radical change in recent years. Consumer habit changes following the COVID-19 pandemic, coupled with the introduction of reforms related to whiplash and soft tissue injuries from road traffic accidents, have led to a significant reduction in the number of claims made. Data provided by the Claims Recovery Unit of the Ministry of Justice (CRU) and the Official Injury Claim portal for small claims (OIC) showed that the number of new claims registered in 2023 for road traffic accidents in England and Wales (RTA) was down 5% compared to 2022 (which was down 7% on 2021), and down 46% compared to 2019, prior to the pandemic and small claims reforms. For non-RTA claims, which include employer’s liability, public liability and occupier’s liability, claim volumes increased by 7% in 2023, although much of this increase came from public and occupier’s liability claims, which typically generate lower fees than employer’s liability. Despite this year-on-year improvement, claim volumes remain 38% lower than 2019. As a consequence, we estimate the claimant side personal injury market to be worth £1.05bn in 2022/23 compared to £1.6bn in 2019/20. Our strategy for personal injury is to grow the number of accident victims we can support via our National Accident Helpline brand and to process an increasing number of these claims through NAL to develop a sustainable, higher margin business. While consumer behaviour changes following the COVID-19 pandemic, and the implementation of Civil Liability Act 2018 (Whiplash Reforms) – which reduced compensation payable to claimants for most RTA claims worth less than £5,000 – have both had a significant impact on overall claim volumes, there is nevertheless a large opportunity for claimant law firms amongst people who have not yet pursued a valid claim.

The personal injury business operates a flexible model whereby personal injury enquiries can be placed into our own wholly owned law firm, NAL, our joint venture law firms or our panel of solicitors. Placing enquiries with the panel generates quick profit and cash but at lower overall levels than processing through NAL. Since the small claims reforms came into effect in June 2021, NAL has been processing the majority of the RTA enquiries generated by the National Accident Helpline brand. In 2023, we further refined our placement strategy, developing a small RTA panel to help balance short-term profit and cash as we started to process an increasing number of non-RTA claims. Our strategy of placing an increasing number of claims into NAL since launch in 2019 is now translating into a rapid growth in case settlements as an increasing proportion of those claims reach the end of the legal process. Furthermore, as the business scales, NAL is able to benefit from operational leverage to increase its profitability, whilst still utilising its flexible placement model to balance short-term profit and cash with higher long-term returns. Over time, we are realising our ambitions to grow NAL by processing a higher proportion of our enquiries ourselves, whilst also mitigating the risk of reduced panel demand arising from an increasingly consolidated market.

Our investment case and business model

The Group’s personal injury business model is built on three pillars:

-

a highly productive marketing engine, powered by the sector’s most trusted brand, National Accident Helpline;

-

an efficient, technology-enabled and purpose-built law firm, National Accident Law, which is focused on the consumer; and

-

an agile and scalable placement model designed to balance the work we place with our panel for in-year profit and cash with the work we process ourselves for greater, but deferred, profit and cash.

The combined strengths of these pillars uniquely position Consumer Legal Services to profitably service high-volume segments of its market, whilst enabling the division to optimise its returns from higher-value segments of the claims market. The division completed its three-year investment programme in 2020, which laid the foundations for the growth of our own law firm, National Accident Law, and prepared the business for the market reforms implemented in May 2021.

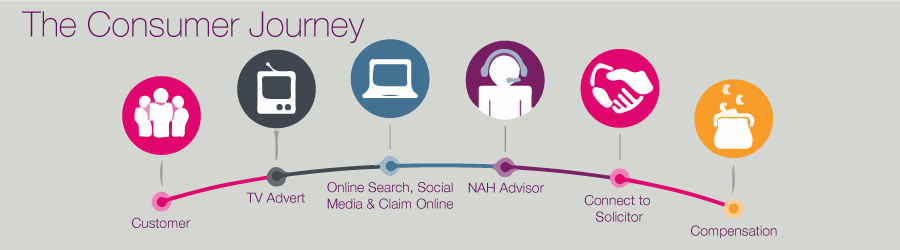

The strong market awareness of our National Accident Helpline brand and its highly optimised website generates a high volume of leads which we triage through our customer contact centre to identify enquiries with the greatest potential of success. Our investments in digital customer journeys means that an increasing number of enquiries are generated entirely online at a reduced cost. We monetise qualified enquiries through our flexible placement model. Enquiries either proceed directly to our in-house processing law firm, National Accident Law, or are dealt with by one of the specialists on our panel of law firms. We no longer place large volumes with our joint venture firms now that we have our own in-house firm, as National Accident Law offers us a better return and a simpler journey for the customer.

For more information, please visit our consumer sites: